King James I of England, VI of Scotland and I of Ireland was given the sobriquet, the ‘wisest fool in Christendom’, by the King of France, Henry IV who was more fortunate being known by the epithets ‘Good King Henry’ and ‘Henry the Great’.

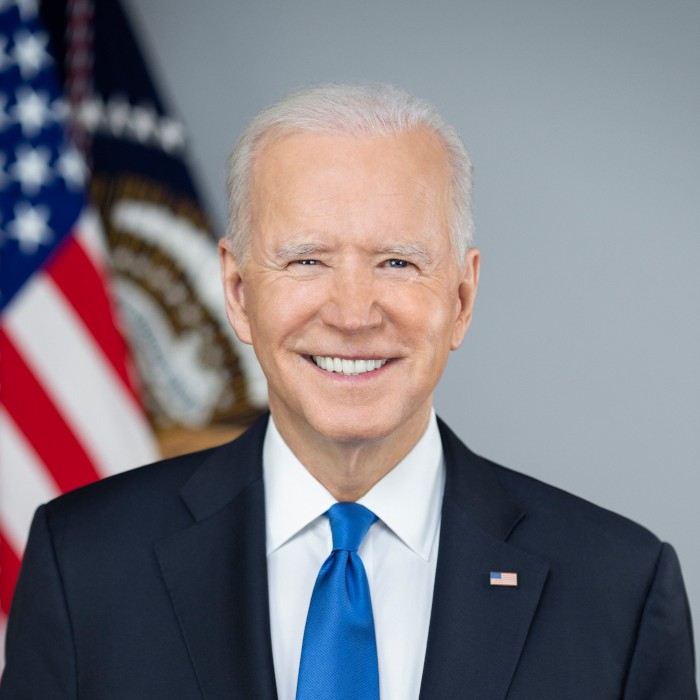

Leaders are often the object of unflattering comments and descriptions, President Joe Biden being no exception. Mr Biden’s Detractor in Chief being a certain President Donald Trump Mr Biden’s predecessor.

One of the realities of politics is that often a leader’s critics will criticise and denigrate a leader for a policy decision, which were their positions reversed the critic would make the very same policy decision and the leader would make the very same criticism!

In yesterday’s blog-post we drew the readers’s attention to the rumours circulating about the US replacing it’s fiat currency (the US $) with a CBDC (Central Bank Digital Currency) at the end of this month.

We further speculated that given the inter-relationships of international trade between the USA, EU and the UK that all three currency zones might adopt the same policy simultaneously. This to stop deleterious speculation from traders trying to short out the other currencies causing chaos.

Were the EU, the UK and the USA to transition their fiat currencies “overnight” into CBDCs these joint actions are fraught with some perilous risks.

Firstly the “overnight” aspect would be crucial. Why. Because were a nation to make a statement that on a certain date in the future the fiat currency would be terminated and the new CBDC would replace it, the speculation against that currency would be severe. We in the UK experienced a little of what that would be like on Black Wednesday. Black Wednesday, or the 1992 sterling crisis, was a financial crisis that occurred on 16 September 1992 when the UK Government was forced to withdraw sterling from the (first) European Exchange Rate Mechanism (ERM I), following a failed attempt to keep its exchange rate above the lower limit required for ERM participation.

Secondly the security. Any “leak” tipping the currency markets off would spell disaster. By it’s very nature such a change has to be sudden and overnight. The practical effects would be that customers of banks (business and personal) would have a limited time in which they could pay in their cash to their accounts. There would in fact be a transition period. Working on the basis that the CBDCs will be set up at 2PM Eastern Standard Time being 7PM Greenwich Mean Time and 8PM Central European Time on Wednesday 31 January 2024, individuals and businesses would be able to use the M0 (notes and coins in circulation) of the old fiat currency for a set period.

There are many would would state that this would be highly disruptive. It would not be. We in the UK and Ireland underwent something far more disruptive back in Decimal Day in the United Kingdom and in Ireland was Monday 15 February 1971, the day on which each country decimalised its respective £sd currency of pounds, shillings, and pence.

The BIGGEST RISK for the EU, the UK and the USA would lie in what certain other countries would do as a result.

Along with speculation and rumours about the EU, the UK and the USA adopting CBDCs, theere has been speculation and rumours about the BRICS countries (Brazil, Russia, India, China and South Africa) adopting a gold backed common currency.

The BG does not consider such a development likely. The BG does however considers that certain members of BRICS – notably China, India and Russia – might themselves adopt their own gold backed fiat currencies.

Were these currencies to do this the consequences for the EU, the UK and the USA would be severe. This because these currencies if all backed by gold would have a set exchange rate between themselves as each currency; the Chinese Yuan, the Russian Ruble and the Indian Rupee would each have a value against a certain weight of gold bullion and thus would be linked to each other by a common baseline valuation (the price of gold) which would result in a de-facto fixed inter currency exchange rate.

The effects on international trade would be far reaching and profound. It would be hard to overstate the significance of such. This because over a very short space of time these three gold backed fiat currencies would become the de-facto reserve currency! It would be a financial triple alliance of the 21st Century!

Almost overnight the USA would have surrendered it’s position as the holder of the world’s reserve currency and handed this prize to it’s two chief adversaries (China and Russia) and an up and coming power, India.

Politically there would be two significant casualties: President Joe Biden and Prime Minister Rishi Sunak. Both men are facing re-election in 2024 and such a development is hardly likely to improve their chances!

GOTO: https://thelondonfinancial.com/featured/gold-backed-brics-currency-de-dollarization