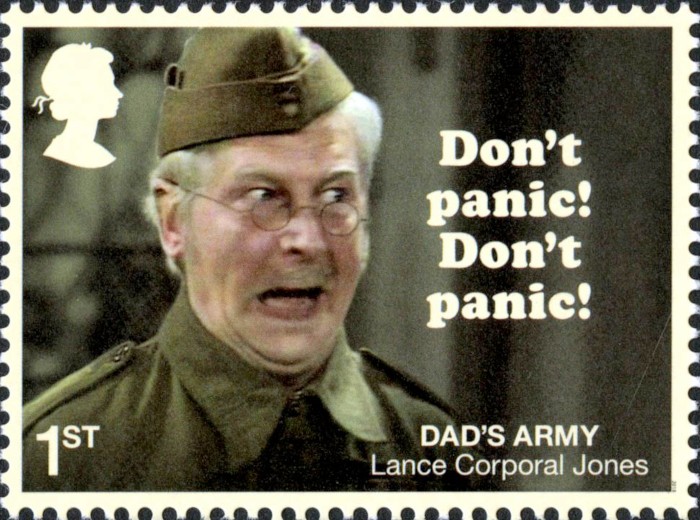

On 26th June 2018, to celebrate 50 years since the first broadcast of Dad’s Army, Royal Mail issued a set of eight stamps to commemorate its iconic characters and their catchphrases. Above is Lance Corporal Jones with his oft shouted “Don’t Panic!”

Lance Corporal Jones’s advice is often well justified. This can particularly be the case when investing in or gambling on the stock market!

The general “run of the mill” advice an ordinary person will receive from a financial adviser will be to “spread the risk”. By that they not only mean spread the money over a number of different companies but choose companies in different industrial sectors and also different geographical sectors.

They will however ask: “What are your investment objectives? Capital growth, income or a combination of both?”

Many advisers will recommend investment trusts. These are companies that invest in other companies and are managed by professional fund managers who generally know what they are doing and are well qualified. They are able to do a better job that the average man or woman in the street. These investments trusts will have themselves have publicly declared investment objectives generally; capital growth, income or a combination of both.

I advised my late father in the 1990s to sell his considerable shareholding in Lloyds Bank and to purchase shares in the Dunedin Income Growth Investment Trust PLC using a subsidised share exchange scheme (long withdrawn). He followed my advice only after considerable nagging by my late mother. He was unhappy with his decision. It turned out to be the right one. For him, for my mother and latterly for me!

When I downsized in 2013 and moved from the West Riding of Yorkshire to Cornwall I used half the sale proceeds of the house sale to invest in stocks to increase my income.

My first thought was to invest the money in the above mentioned investment trust. I did not however. This because I calculated how much income I required and then sought to generate this figure from the money I had to invest. As a result I invested in two well known dividend stocks Royal Dutch Shell and SSE. I also invested in Phoenix Group which at the time was registered in the Cayman Islands. It is now a FTSE 100 company. Whilst I have sold the RDS and SSE shares (at a profit – a very small one in the case of RDS), I have in fact increased over time my holdings in Phoenix Group PLC (https://www.thephoenixgroup.com/). So much so that financial advisers would state that I am dangerously overweight in Phoenix.

Because of my heavily obese position in Phoenix Group PLC, I have also doubled the number of shares I hold in the Dunedin Income Growth Investment Trust PLC (https://www.dunedinincomegrowth.co.uk/). This is very important as it represents the core of my investment portfolio and allows me to have a spread of risk across investment sectors and some geographical spread outside the UK.

Other stocks I hold are in Lloyds Banking Group (https://www.lloydsbank.com/), Rio Tinto PLC [formerly Rio Tinto Zinc] (https://www.riotinto.com/) a company I used to work for. I also hold shares in another company that shall remain unidentified as identifying it would only serve to increase the blood pressure of members of the Politically Correct Brigade!

Phoenix Group PLC has not done too well in terms of its share price of late. It is however important to realise that what drives a share price includes not only the accounting data a PLC is required by law to publish but also market sentiment. In contrast, a well run company (and Phoenix Group PLC is a very well run company) pays a dividend it can afford to pay based on the cash it has at it’s disposal.

Although I was pleased to spot and read the following article by Mr Cliff D’Arcy (https://www.fool.co.uk/2023/10/16/down-28-in-8-months-i-think-phoenix-group-shares-should-rise-from-the-ashes/) I will NOT be taking his advice to buy more Phoenix shares because to do so would be foolish given my heavily obese position. However at their current level (as of the date of posting) the shares do in my opinion offer a excellent income source to a person seeking income but not too concerned about the prospects of capital growth.

When making investment decisions it is vital to look at one’s overall financial position. This cannot be overstated! For moi, an absolutely HUGE factor since the fall of 2021 has been my receipt of the UK’s State Pension! Not only is the annual sum I receive important but also the fact that I receive said sum in 13 four weekly payments that helps the cash flow in terms of daily living costs. Living on this sum alone would be difficult but with my investment income I am happy to say I am able to live comfortably but modestly. In other words I can’t afford to live here (https://youtu.be/Y-lVrNTje_E?si=le-cUGQATSwV9oku) and adopt the billionaire lifestyle of the super-rich!

NB: Nothing in the above blog-post is investment advice and must NOT be construed as such!