When a police officer in the course of his duty comes across a person about to commit suicide, their duty is of course to try and rescue that person from their intended action. The officer will try and strike up a conversation with the person and will attempt to calm them. He will tell them that whatever is troubling them, nothing can be so dire as to require such an irrevocable step. Were it not his duty, common decency and a basic sense of honour would cause the police officer to react they way he would. We would expect nothing less.

When a police officer in the course of his duty comes across a person about to commit suicide, their duty is of course to try and rescue that person from their intended action. The officer will try and strike up a conversation with the person and will attempt to calm them. He will tell them that whatever is troubling them, nothing can be so dire as to require such an irrevocable step. Were it not his duty, common decency and a basic sense of honour would cause the police officer to react they way he would. We would expect nothing less.

Thus it was, the British Gazette in its article; The Euro: On course for disaster of 20th May, 2011, gave the well intentioned advice to the Eurozone leaders to save themselves. This meant – and still means – to cut loose those Eurozone economies that threaten its existence.

We used the analogy of a sailing ship in a storm and a foolish Master refusing to reef (take in sail). We could have used another maritime analogy – of a lifeboat in heavy seas with two many bodies in. The thing to do in such circumstance is to throw the bodies of the dead overboard to try and save the living. If not the boat could take in water and eventually swamp, causing all to drown.

It appears that the Eurozone leaders have decided not to take the British Gazette’s advice. Does this mean that the Euro is doomed?

Yes. The question now is not if the Euro can survive. the question is: For how long? We cannot give a date.

However, the euro is doomed. It cannot survive in its present form. It could extend its lifespan if the Eurozone leaders take action.

In order to restore the confidence of the international money and stock markets such action HAS to be dramatic. The term used amongst the cognoscenti is “ahead of the curve.” Only by being “ahead of the curve” can their action result in success. Another term used by the cognoscenti is “shock and awe” borrowed of course from the US Pentagon – coined upon the occasion of the attack on Saddam Hussein’s Iraq.

Because the Eurozone has left it so late, such action will have to be far more dramatic than it would have to have been earlier. However, Eurozone leaders have another problem: the US downgrade from AAA to AA+. For the Eurozone, this could not have come at a more awkward time.

In trying to navigate their way out of the mess one is reminded of the tale of Charybdis and Scylla: Charybdis once a beautiful naiad and the daughter of Poseidon, enraged Zeus who changed her into a monster. As a monster Charybdis lay on one side of a narrow channel of water. On the other side of the strait was Scylla, another sea-monster. The two sides of the strait are within an arrow’s range of each other, so close that sailors attempting to avoid Charybdis will pass too close to Scylla and vice versa. The idiom ‘between Scylla and Charybdis’ has therefore come to mean being between two dangers, choosing either of which will bring harm.

If the Eurozone leaders are determined to preserve the Euro, they must take the action this organ stated in our article of the 20th May. That is to ensure that the European Central Bank and the European Commission have SOLE COMPETENCE so far as taxation, monetary and fiscal policy is concerned. This of course will reduce the Eurozone member states to the status of provinces. Such a dramatic act – which would mean that the individual sovereign debts of all the Eurozone members would be unified as the European Union sovereign debt, would result in Monet’s dream coming true: a United States of Europe. Such a development WOULD have sufficient “shock and awe” to restore market confidence.

Of course such a development would cause the new federal state to quickly wish to press ahead further and assume sole competence in foreign affairs and defence.

Were the original six founding members of the European Community to do this, plus let us say, Austria, such a development would be survivable as the Italian sovereign debt, though huge, would be reasonably manageable. If however the Eurozone leaders attempt to maintain all existing member states within the Euro and enact this uniting action they will have sown the seeds of the European Union’s destruction.

Why?

Its rather simple and rather obvious: Reducing such as Greece to the status of province – as she was when a Vilayet of the Ottoman Empire – and then imposing the necessary drastic increases in taxes and reductions in public spending will cause the peoples in these provinces to rebel.

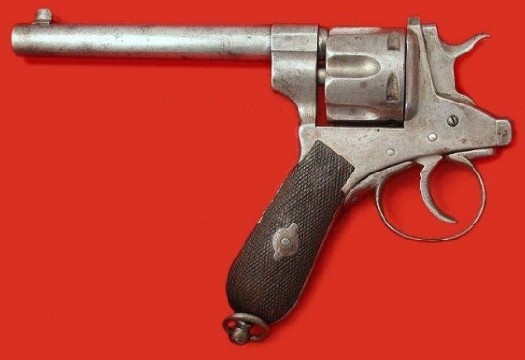

Thus maybe the British Gazette should be less honourable in its advice. Maybe we should say: Go on. Go ahead. Shoot yourself in the head.

Speaking the Truth unto the Nation

Such a messy end to thoroughly detestable idea is, I believe , somewhat of a headache to us all. The analogy of the gun might be better were the gun a shot gun….splattering chaos to all, far and near. How did we let these nutters do it to us?………I fear that it is too late to avoid catastrophe!

I hate to disagree, but the owners of, all world banks, are the family Rothschilde, and they invented ‘money as debt’ the banking system they foisted upon us. Having financed both sides, as usual, during the Second World War, it was they who replaced gold and silver, as the world’s monetary reserves, with the worthless paper promissory note system, in use today.

Those countries in debt, should, as should Britain, scrap the system whereby it borrows money, with interest, from the Rothchilde’s, and printed its own, interest free money. All municipal projects should be financed with interest free loans, as should loans to industry, the bank should be made to share the risk, and therefore ensure an end to reckless lending.

Usury is the seed that creates inflation, and unemployment, greed has no place in public affairs.