Faced with the need to increase taxes and cut public spending AT THE SAME TIME, Chancellor of the Exchequer George Osborne is putting together a damage (to his chances of being re-elected) limitation measure by calling on the public to put forward their ideas on how to meet the challenge.

Faced with the need to increase taxes and cut public spending AT THE SAME TIME, Chancellor of the Exchequer George Osborne is putting together a damage (to his chances of being re-elected) limitation measure by calling on the public to put forward their ideas on how to meet the challenge.

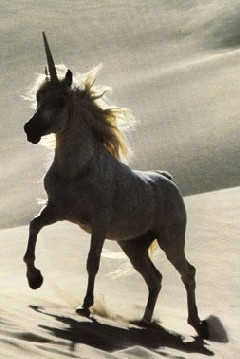

Of course the problem poor George has of course is that the public will always want to see the other guy taxed and not them. Of course the “other guy” like the unicorn does not exist!

Many on the left of British politics will argue (correctly) that cutting public spending will cost money because those workers formerly employed paying taxes will no longer be employed and therefore no longer paying taxes but instead will be in receipt of public support. This is true – in part but their argument falls down because essentially, public sector workers are paid for by the taxes placed on the private sector and it is the private sector that creates the wealth and profits that can then be taxed.

The British Gazette however will respond positively to the chancellor’s request and puts forward these suggestions:

1. Withdraw from the European Union – this will save billions.

2. Abandon the nonsensical “Climate Change Agenda” – this will save billions.

Of course, George will not being doing either of these things. So let us confine the remaining comments to the invidious reality of the UK remaining within the abomination that is the never to be sufficiently damned European Union.

3. Withdraw British troops from Afghanistan. This will save huge sums of money immediately. The problem with suggestions such as “cancel Trident” is that the need is for immediate savings – Trident will not be costing us much money for many years. Most importantly however, there is a pressing military need as our troops are overstretched – withdrawl of our troops is the option that professional military commanders would advocate in the circumstances. This will be popular amongst the public.

4. Cancel the £30 billion cost of the High Speed Rail project that if built will knock 30 minutes off the journey time from Leeds to London. That is £1 billion per minute! We at the British Gazette make regular trips to London from Leeds and can categorically state that £1 billion a minute is NOT WORTH IT!

5. Simplify the tax structure by:

A. Merge the tax and benefits system together so most people will pay in and some people will get pay outs. This will effectively mean that all state benefits will be “means tested.”

B. Introduce a standard rate of income, capital gains and corporation tax of 34%. This will mean that the marginal rate at which people seriously consider migrating to a tax haven is raised considerably.

C. Raise the standard rate of VAT to as much as is needed.

D. Abolish Inheritance Tax and replace it with a Succession Duty charged at a rate of 34% with the threshold at which the beneficiary pays the duty based upon the net worth of the beneficiary and not the deceased. This will mean that the Legal Services Act should be amended to remove preparing and/or assisting in the preparation of letters pertaining to a grant of administration or probate from the list of “reserved legal activities.”

E. Abolish Employer’s National Insurance Contributions.

F. Reduce National Insurance Contributions to the standard Class 2 self employed rate for everybody.

G. Raise the personal allowance (at which people start paying tax) to as high as possible within the obvious constraints of the predicament the country is in.

H. Abolish Council Tax and introduce a Local Income Tax to be set by the authorities who used to levy council tax but to be collected through the centralised tax system.

Speaking the Truth unto the Nation