One of my pet irritants (the word “hate” is grotesquely overused) is when journalists refer to those buying and selling shares as “investors”. There are indeed “investors” who buy and sell shares. However there are many more who would better be described as “gamblers.” These are people who will invest short term and will often use high risk methods such as Contracts For Difference (CFD).

There is a phrase used in the banking and finance industry; “risk appetite” – the meaning of which is self explanatory.

Back in January 2014 when I was faced with a choice of what to do with the residue of my “property downsize”, I chose to increase my risk appetite. What I would liked to have done would have been to invest the proceeds in two investment trusts, in which I already had shares. These were the Dunedin Income Growth Investment Trust and the Temple Bar Investment Trust. However, I did not. This was because a quick calculation showed that the income was not quite sufficient for what I anticipated would be a comfortable income. As a result I decided to invest directly in two leading FTSE companies and another company, now a FTSE stock but then domiciled in the Cayman Islands. One of the two major FTSE stocks was Royal Dutch Shell. RDS was a standard “go to” stock for income investors. Many institutions have major holdings in this stock. It formed a core of my investment portfolio. Thus when the dividend was slashed during the coronavirus crisis, it had a dramatic effect on me and my income.

I was advised by a friend to sell these shares and to invest in a unit trust specialising in the area of high technology and robotics. I did not. I was not going to realise such a dramatic capital loss.

Between 3rd January 2014 and 2nd May 2017 I purchased a total of 6,000 shares and my average cost per share is £18.87. On 8th October 2020 the share price fell to a low of £8.66.

My strategy was one of “Watch, wait and see.”

It still is.

Yesterday the share price closed at £17.16.

IF the shares reach £19 per share, I will very likely sell. There are of course stock brokering and statutory costs and thus this will result in a capital gain of approximately £130!

If as expected, I sell, what will I do with the money?

Buy more shares in another company or companies is my answer.

Ideally, I would like to purchase shares in a company or companies which would provide the same level of income that I used to receive before Shell’s dividend was so dramatically cut. At the same time I would wish to seek some level of capital security inasmuch as not investing in a company or companies that may go bankrupt!

The “safe and sensible solution” would be to invest the proceeds in such as the Dunedin Income Growth Investment Trust and/or the Temple Bar Investment Trust.

There are other solutions that require a higher “risk appetite”. There are a number of companies which traditionally were “go to” stocks for “income investors” – a prominent one being of course Shell!

Royal Dutch Shell still seeks the support of these investors. Since the institutional investors dominate the shareholders register of most major companies, Shell’s board of directors are adopting a “climate friendly strategy” which means “going green”.

It is the climate change issue that has caused Shell and other “fossil fuel stocks” to become the subject of climate change campaigners demanding disinvestment and/or changes of strategy (by the said companies).

There now are a number of companies who used to be regarded as “go to” stocks by the institutions but who are now shunned by the same. These include what are known as “tobacco stocks”. Other stocks include “defence industry stocks”.

When my late father sold the bulk of his Lloyds Bank shares in the 1990s and reinvested in the Dunedin Income Growth Investment Trust, that trust had a major holding in oil companies and also tobacco and defence industry stocks. This has now changed. This is because the managers of the company realise that there are many “well-to-do” wealthy middle class people who do not want to invest in companies they deem unethical. Ethical investment has become the “in thing” now.

Of course, there are still persons who are prepared to invest in tobacco and defence industry stocks.

An illustration of the pressure companies such as Royal Dutch Shell are subject to is demonstrated by the news report below:

The reason for the regulator’s rejection of course is political! The officials declined Shell’s proposal because they were INSTRUCTED to! By the politicians! This because the UK government are hosting the COP 26 conference in Glasgow between Sunday, 31st October 2021 (Halloween) and Friday, 12th November 2021.

Expect Royal Dutch Shell to seek a judicial review of the decision and for the court to rule there should be a reassessment. Expect Royal Dutch Shell to submit altered plans and for the regulator to approve same!

For the short term, I am bullish about Royal Dutch Shell’s prospects insofar as the share price is concerned. I am buoyed up after reading this opinion:

GOTO: https://seekingalpha.com/article/4459152-shells-financial-results-will-be-greatly-boosted-by-lng

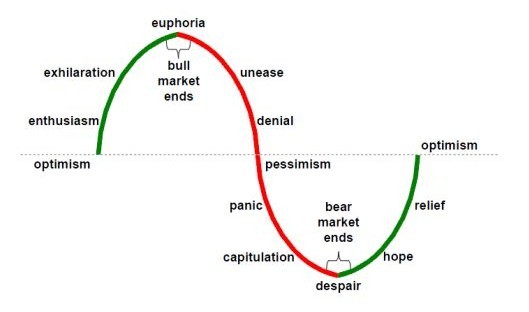

The FACT is that stock markets the world over are driven by two fundamental forces: GREED and FEAR! This is driven by a tendency by those who would label themselves as “investors” risking assets they can not comfortably afford to loose! These people are deluding themselves! They should recognise what they are: GAMBLERS!