If the uninformed person wishes to understand the nature of the Great Project that is the European Union, they should visit the Hall of Mirrors (Grande Galerie or Galerie des Glaces), the central gallery of the Palace of Versailles in Versailles, France.

If the uninformed person wishes to understand the nature of the Great Project that is the European Union, they should visit the Hall of Mirrors (Grande Galerie or Galerie des Glaces), the central gallery of the Palace of Versailles in Versailles, France.

The Hall of Mirrors is the grandest expression of renaissance European baroque. It is on a scale that is truly monumental and demonstrates the absolutist nature of the Ancien Régime of Louis XIV, aka “the Sun King” (le Roi-Soleil).

As with le Galerie des Glaces, so it is with the Euro. A project so grand and of such monumental proportions it almost takes one’s breath away. The similarities continue.

– The construction of Versailles almost broke the French state economically – as the Euro threatens to do to those countries that comprise the Eurozone.

– Both projects were flawed. In the 17th century, mirrors were among the most expensive items to possess at the time; the Venetian Republic held the monopoly on the manufacture of mirrors. Jean-Baptiste Colbert the Controller-General of Finances and Minister for the Maison du Roi saw to it that the Manufacture royale de glaces de miroirs be set up to make the mirrors in France. This investment in skills acquisition enormously increased the cost of an already overly extravagant vanity project. In the case of the Euro, whilst there exists a common currency there does not exist a common sovereign debt so all members are free to issue government paper (Euro bonds). This of course was the inevitable recipe for the economic travails we see before us. Both flaws were predicable.

The problem for the Eurozone members however is that they have all lashed themselves to the wheel of the ship. The ship (by “ship” we mean a square rigged sailing vessel – which is the original meaning of the word “ship”). The ship has been caught in a storm. Unfortunately none of the crew saw fit to reef (take in sail) so the sea is playing with the ship tossing it wildly! One course of action would be for some of the crew to untie themselves from the wheel and to climb the mast and take in sail. “Sounds like a plan!” You shout Dear Reader. There is however a problem. If even one crew member releases themselves from the wheel the crew will loose control of the ship’s course and the wind will take over and blow her onto the rocks. Then it will be all over.

As it is with our crew on the ship, so it is with the Eurozone members. If Greece leaves the Euro (and the EU as well) the effect on Greece will be dire. Imagine you are a Greek person Dear Reader. You have a deposit account at the bank. It has 100,000 Euros in it. Your life savings. Suppose on 1st August 2015, Greece leaves the Eurozone and the Drachma is reintroduced at a rate of exchange is say 100 Drachmas to 1 Euro. This means that on 1st August 2015 your deposit account will show a balance of 10,000,000 Drachma. You feel rich! However on the 1st January 2016 the Rate of Exchange is 1,000 Drachmas to 1 Euro. This means that your 10,000,000 Drachma are worth 10,000 Euros. You Dear Reader would not be a happy bunny!

Then there are the consequences for other Eurzone members. Particularly, Portugal, Spain, Ireland and Italy. The cost these governments will have to pay on their debt would go up.

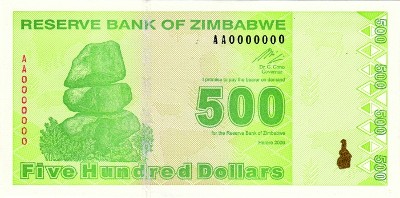

Side Note: Use of the Zimbabwean dollar (fourth issue note below) as an official currency was effectively abandoned on 12th April 2009. The Zimbabwean dollar is due to be demonetised (no longer legal tender) by the end of 2015.

Speaking the Truth unto the Nation