The delay of the Halloween financial statement and it’s upgrade to an autumn statement of the 17th November 2022 is going to be the big test for Messrs. Sunak & Hunt.

With U turns becoming almost commonplace I will not be surprised if Mr Hunt announces another U turn – announcing a reversal from Mrs O’Leary’s stance of no windfall tax to a windfall tax. This will of course excite much mirthful comment from the opposition benches! However it will place more purple (got by mixing red to blue) water between the Sunak ministry and the Truss Ministry.

Reports like this (https://www.bbc.co.uk/news/business-63409687) will only serve to increase the pressure for such a U turn.

Shell’s CEO is expecting such!

GOTO: https://seekingalpha.com/news/3896338-shell-must-embrace-higher-taxes-ceo-says-as-q3-profits-soar

The reason for doing this is clear: HM Treasury needs the money!

It is fairly safe to assume that Mr Wallace continuing as Defence Secretary means that the commitment to increase UK defence expenditure from 2% GDP to 3% GDP is maintained.

It is fairly safe to assume that Mr Cleverly continuing as Foreign Secretary means that the commitment to support the Zelenskyy administration in Ukraine is maintained.

There are two big financial commitments Messrs Sunak & Hunt have got to decide upon:

#1: Do they uprate benefits by the rate of inflation for September 2022 (10.1%).

#2: Do they uprate the state pension by the rate of inflation for September 2022 (10.1%).

IF they do not they will be very unpopular.

IF they do then the demographic most inclined to vote will be not infuriated as they otherwise would be!

Messrs Sunak & Hunt have a problem. An expensive one! They cannot increase pensions by 10.1% without increasing benefit by 10.1%!

Whilst these to commitments will cost a lot most of the money will be immediately injected back into the economy as the lower income population can and will spend it immediately. The state pension is of course universal and many wealthy pensioners receive it. They regard it as a bonus.

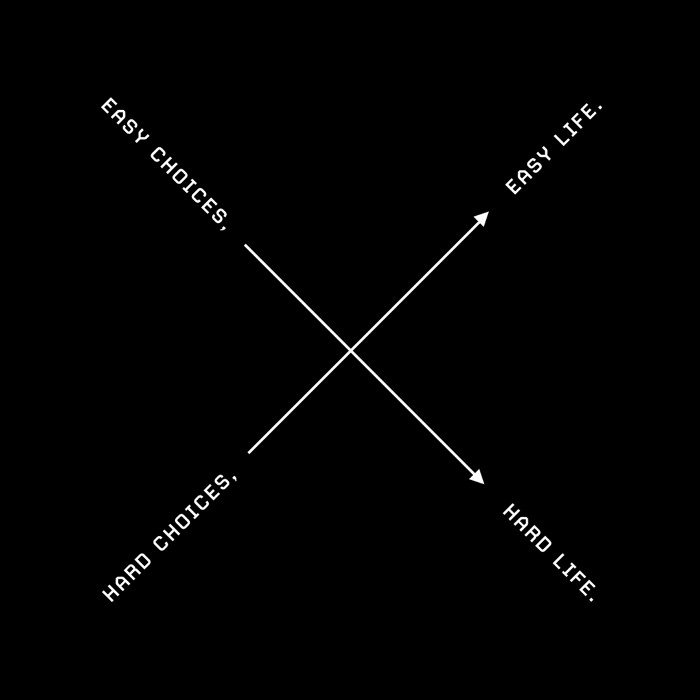

The plain simple FACT of the matter is this: There are NO easy choices when it comes to making decisions about cutting public expenditure and also increasing taxes! The one rule about taxation is this: Voters tend to support those taxes levied on people other than themselves! Thus to the teetotal increasing alcohol duties is not an issue! To the non smoker increasing tobacco duties is not an issue! This is why governments across the world have problems balancing the books!

On the thorny issue of pensions and benefits, Messrs Sunak & Hunt might go for a halfway house approach: Increase both sets of payments by the following formula: The arithmetic mean from the rate of inflation for September (10.1%) and the base rate of increase (2.5%) would result in an increase of 6.3%.

My state pension is currently £740.60 every 4 weeks equating to £9,627.80 pa. Increasing this by 10.1% results in £10,600.21 pa. Increasing this by 2.5% results in £9,868.50 pa. An increase of 6.3% results in £10,234.35 pa. Of course, a simple “half-way house” increase of 5% (half the rounded down to the integer rate of inflation for September 2022 and double the 2.5% base increase would cost less and provide me with £10,109.19 pa. The important thing to note is that a “half-way house” increase of 5% would put the annual payment over the £10,000 pa figure.

The problem for Messrs Sunak & Hunt is that ANYTHING less than 10.1% for benefits and state pensioners will result in howls of protest!

2002 should be 2022

Proof reading is a task that should be undertaken by all who publish.

If not it should be delegated to a competent sub editor.

Thanks!