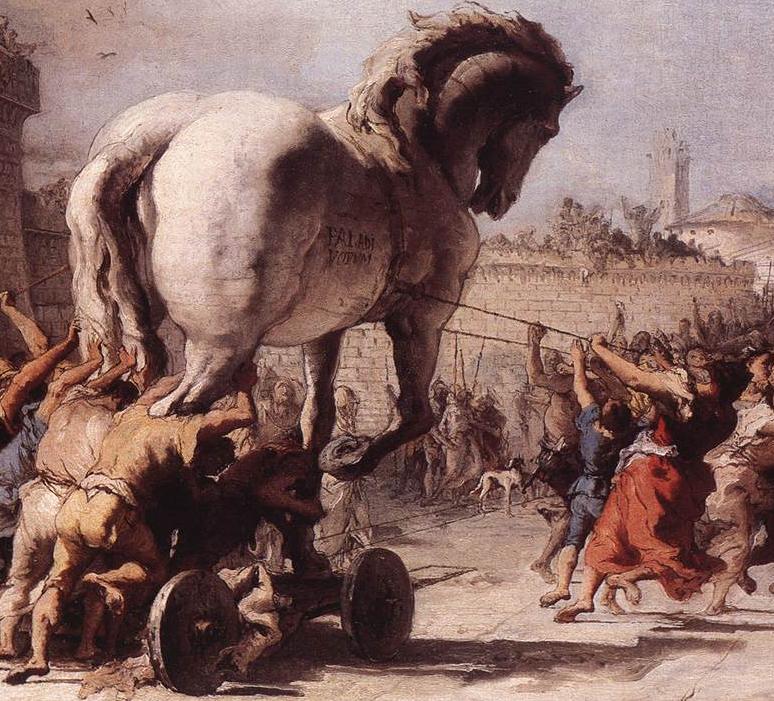

Above, the Procession of the Trojan Horse in Troy by Domenico Tiepolo (1773), inspired by Virgil’s Aeneid (click on the image for full size rendition).

Above, the Procession of the Trojan Horse in Troy by Domenico Tiepolo (1773), inspired by Virgil’s Aeneid (click on the image for full size rendition).

Such is the dilemma the European Union finds itself in with Greece.

The politicians that comprise the government and legislature of Greece have agreed to the EU’s terms for the bailout money.

Anybody who thinks the crisis is now over is living on another planet.

What everyone might not be aware of is that the EU is not simply going to hand over several large lorry loads of Euros to the Greek Finance Minister. Frau Doktor Merkel is no fool – as the British Gazette has repeatedly reminded its readers. The bailout money will instead be placed in an escrow account and will be made available if, as and when the Greeks make good on their commitments. In other words: No [public spending] cuts; No money.

The Greek government will likely begin to implement the cuts between now and March when Greece needs to make a payment on her debt. It is likely that this payment will be made. However, the Greek people go to the polls in April and quiet frankly, all bets are off on the result.

If as is likely the huge discontent and anger of Greeks is made manifest in the results, a very different set of politicians will be elected. At that point the Eurozone train could hit the buffers.

Doubtless British Gazette readers will recall that part of the Trojan tale, that whilst questioning Sinon, the Trojan priest Laocoön guessed the plot and warned the Trojans, in Virgil’s famous line “Timeo Danaos et dona ferentes” (I fear Greeks even those bearing gifts). And also the result; that Poseidon sent two sea serpents to strangle Laocoön and his sons Antiphantes and Thymbraeus, before any Trojan believed the warning.

We will leave our readers to draw parallels. Watch this space……………….

Speaking the Truth unto the Nation

The Greeks were lured into debt, by the banks of France a Germany, with their calculated irresponsible lending policy, much like our own credit card holders who, if they make the minimum monthly repayment, are simply paying the interest.

The IMF who notoriously lent Nigeria £5billion in 1986, said in 2,000 after Nigeria had repaid £16billion, “you still owe us £28billion.”

The Greeks would be better off telling Germany and the EU where to stick its loan default on all interest on its debts, leave the EU and print its own currency, from which it could refinance its infrastructure with interest free loans from its own bank.

At a stroke it would become free of green taxes making it more competitive than the est of the EU. Its tourist trade would benefit too.

But this EU stitch up, ensures no growth in Greece for decades. We should, if we were a democratic country, shun the EU and all it stands for.